21 July 2022

| Period | Return |

|---|---|

| 2020 (starting 11 November 2020) | +3.42% |

| 2021 | +18.09% |

| 2022 | |

| *** 1Q | -22.50% |

| *** 2Q | -1.21% |

BEEPING Holding Company Discounts

Dear Co-Investor

We feel the need to say: ‘Cheer Up!’ – this moment too shall pass. In the face of uncertainties, persistently negative headlines, and downbeat sentiment, it is always more helpful to lengthen perspective when others are shortening theirs.

| 2Q22 Return | |

| NASDAQ Composite | -22% |

| JSE Top 40 Index | -12% |

| S&P 500 | -16% |

| Invesco China Golden Dragon Index | +13% |

| USDZAR | +11 |

We’ve cautioned before that our portfolio composition does not resemble any of the indices and so we may zig when the indices zag from time to time.

We think that given the declines in major indices this quarter, the fund largely absorbed the market movements well.

This is in part due to some opportunistic hedges that we have had in place for some months. Our objective when using hedges is not to dampen volatility but rather to create liquidity to reinvest in portfolio companies that are ‘thrown out with the bathwater’ so to speak.

Secondly, counter to developed market declines, some of our portfolio companies in China started to see share price appreciation.

Over a decade, equity investors are likely to see a few bear markets. Returns over a decade are determined by what one does in the middle of a bear market. Contrary to many participants who run away from uncertainty, we have increased our investments in companies that we believe will generate substantial wealth creation over the long term.

We can offer no predictions on when the market downturn will end. We’ve been through these environments a few times before and the approach that has worked for us is to buy great businesses at a discount and hold them through the volatility.

With excess capital, we do engage in special situations that have a habit of cropping up in these market environments. These are dislocations that require some knowledge of corporate actions, company law and old-fashioned handicapping. We would not get too excited; the returns on these activities are more like putting ‘ones’ and ‘twos’ on the board rather than hitting sixes (excuse the Cricket terminology). In the past, we have generated some reasonable returns on capital through these activities.

Prosus

Prosus was a helpful contributor to returns during the quarter (we hesitate to call it a ‘victory’ yet). The Prosus share price has an extremely high correlation to Tencent (its largest investment). Yet over the last six months, the Prosus share price has traded at a substantial discount to its underlying assets.

Over and above this, Chinese companies, including Tencent, trade at a significant historical discount for the reasons we mentioned in our 1Q22 letter.

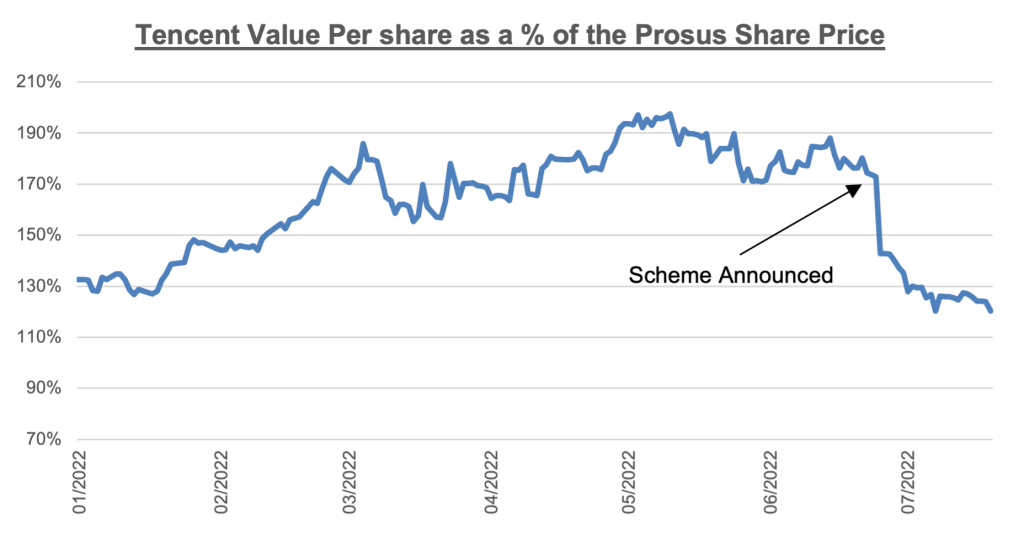

In effect, a Prosus shareholder was getting a discount on a discounted asset. Figure 1 illustrates a simplistic representation of the value of Tencent investment owned by Prosus relative to the Prosus share price (on a per share basis)[1]. At one stage the Tencent investment value was double the Prosus market price.

Figure 1 – Prosus vs. Tencent on a per share basis

Companies trading at such substantial discounts rarely are in perfect shape, but the probability of a permanent loss implied by the market price in March this year was, in our view, wholly unjustified. During the quarter we increased our investment in Prosus substantially.

Watching Prosus’ management deal with this discount has conjured up our childhood memories of Wile E. Coyote and Roadrunner cartoons (the Looney Tunes series). In these cartoons, Wile E. would spend each episode coming up with and executing elaborate plans to catch Roadrunner[2].

For younger readers, a short episode is available here.

Rather than using the most obvious method that nature has given to Coyote, he devises complex schemes to catch his prey. Many of these schemes involved using, sometimes ludicrous, tools that were mail-ordered from ACME Corporation.

Sadly, for Coyote, the plans never end up working out. They inevitably backfire resulting in Road Runner speeding away and shouting, “BEEP BEEP!”.

Figure 2 – One of Wile E. Coyote’s Plans

For years, the show ran in the same format. The cartoon’s director, Chuck Jones wrote in his book ten rules to guide writers of the show (article here). Rules 7-9 are somewhat resonant with the Prosus saga. Just replace ACME corporation with ACME Investment Bank.

Rule 7. All materials, tools, weapons, or mechanical conveniences must be obtained from ACME Corporation [ACME Investment Bank].

Rule 8. Wherever possible, make gravity the Coyote’s greatest enemy

Rule 9. The Coyote is always more humiliated than harmed by his failures.

‘Unlock the Discount’ Project Plan #96

In May, Wile E., ahem, Prosus management announced another plan to unlock the discount. Unfortunately, we don’t have enough space to talk about the ostentatious cross-holding structure implemented in 2021. Or the Prosus listing plan of 2019. All with the purpose to unlock the discount…

As you may work out, these plans ultimately failed and resulted in a wider discount. Management’s remuneration over these periods followed Jones’ rule number 9.

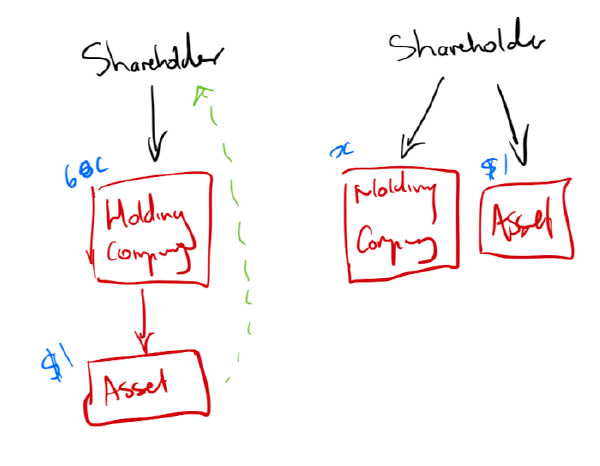

The 2022 plan is to sell some of the Tencent investment and use the same proceeds to buy back discounted Naspers or Prosus shares in the market. In theory, they’re selling an asset worth $1 for 60c to buy the holding company share worth 40c.

Mathematically, this scheme is sound. Alarmingly, the maths works out that on a per share basis, an economic interest in Tencent GOES UP. Looney Tunes indeed!

To date, the discount has narrowed (see Figure 1). Only time will tell if Jones’ rule number 8 will apply, and gravity will be management’s enemy.

Holding Company Discounts

Similarly, to Coyote’s refusal to use his natural animal instincts, management should spin off Tencent to shareholders as a guaranteed way to eliminate the discount. Instead, they’ve gone through many, some would say, ludicrous schemes to avoid this definitive action. Meanwhile, the holding discount remains stubbornly high as it speeds away shouting “BEEP BEEP!”.

For various reasons, holding company discounts are evident across the world. Most management teams shrug their shoulders when the right thing to do for shareholders is to just spin off their holdings. However, a corporate manager’s natural compulsion is to preside over the largest possible empire rather than a smaller one.

We have been infatuated with two South African holding companies (PSG and RMH) that have undertaken the right steps for shareholders recently. These ‘selfless’ managers of these holding companies should be applauded as they have spun off discounted assets to shareholders leaving them with principalities after losing their empires. Shareholders have won across the board.

Brookfield Asset Management (BAM) – The Counterfactual

In our letter last quarter, we talked in detail about our investment in Brookfield Asset Management and a potential value-unlock transaction.

BAM also operates a large holding company trading at a substantial discount. However, management has a better track record in unlocking value.

In our letter we wrote:

During the quarter, management announced that they’re considering splitting their ‘asset heavy’ investments and the ‘asset light’ asset management business. Nothing has been crystalised, but this could be an additional value unlock.

In May, BAM confirmed that they are indeed going through with a transaction to spin off a portion of their ‘asset light’ asset management business by the end of the year.

With all the market turmoil, market participants have surprisingly ignored the potential value unlock. We think this business could end up on a 5-6% dividend yield and create a favourable return for us.

BAM has undertaken many of these spin-offs in the past with great success. Their modus operandi is to seed new businesses utilising holding company capital and then spin them off into new discrete businesses whilst preserving shareholder value. Young up-and-coming managers get to prove their worth running these emerging businesses. Importantly, they need to interface with capital markets (which can sometimes be brutal).

Public investors can directly access their renewables, infrastructure, or private equity funds on the public markets.

Spin-Offs

Spin-offs (or unbundlings in some jurisdictions) are tax-efficient corporate transactions where a holding company simply gives their investment in a business to their shareholders.

As an aside from our discussion: in the past, we find these transactions can offer special situation opportunities for enterprising investors.

What tends to happen is that the spun-off business is smaller (sometimes accompanied by some warts) and a large holding company shareholder does not want it. They indiscriminately sell it in the market once they receive the share to ‘get it off the books’. One of the reasons is it’s too small for their analyst to cover the new business.

Of course, this perspective can be common amongst all the large shareholders, and they also indiscriminately sell their shares. Post transaction, the spun-off business can end up trading at a substantial discount to intrinsic value.

For the enterprising investor, one can pick these up at discount, hold them for a period and then sell them at fair value when the indiscriminate selling ceases.

Unlocking the Prosus Discount

Back to Prosus. As we have discussed, Prosus *should* be spinning off Tencent. Some technical tax excuses have some merit. However, they could take a page from BAM’s management.

Whilst valuations are depressed at the moment, they could spin off all of Prosus’ non-Tencent assets (valued at less than zero by the market). Management could stay with the spun-off company and leave Prosus as a pure Tencent exposure on European and South Africa exchanges.

We think management’s reluctance to undertake rational action is because they fear losing the stable dividend inflow from Tencent. The regular dividend has provided a friendly source of capital to invest in new initiatives rather than having to go to the equity markets to raise capital.

We would expect that their capital allocation knives would be somewhat sharper if they had to undergo this process. There is also the fear that the Prosus spin-off will face the same indiscriminate selling process – which we believe has very high odds.

And then, there is the smaller ‘empire’ thing too.

But as we have shown, BAM management has undertaken these spin-offs several times without the initial diminution of value. This perhaps is indicative of how adroit BAM management is.

The Brookfield Reinsurance Example

In our letter last quarter, we spoke about BAM’s new insurance business. This business is still subscale and is naturally making losses. Management expects that this business in five years could hold $200bn-$300bn of assets (currently $40bn). Despite the nascent stage of the business, management decided to spin off the business to shareholders last year. But guess what, the indiscriminate selling never happened.

In a masterstroke of corporate finance ‘wizardry’, management embedded two elements in the spun-off entity that preserved share value to allow the business time and space to scale:

- Firstly, it made the economic distributions match BAMs. This means that dividend cash flows are the same as BAM.

- Secondly, they created an exchangeability right embedded in the insurance business.

The exchangeability right allows an insurance business shareholder to simply exchange a discounted insurance share for a fully valued BAM share at any time. The implication is that if the share was trading at a 50% discount to BAM, a shareholder could simply exchange the discounted share for a full value one.

The result is that since the spin-off, the insurance share has traded very closely with the BAM share. This has left the management of the insurance business to continue scaling without the overhang of a discounted share price. Shareholders have won too.

Where We See Value

Despite the share price discounts, we believe that the intrinsic value of both businesses will continue to compound at high rates over the coming years. Of course, buying them at substantial discounts simply enhances our overall return.

The good news: from March to the date of writing, Prosus is up 76%. But there is still some BEEPING holding discount left.

We expect that investment bankers are polishing their slides decks for ‘Unlock the Discount’ Project Plan #97

*****

There are always opportunities no matter what the market conditions are. The returns made in later years are created by what we do in bear markets. It’s strange, but we get dreadfully excited in bear markets. Good returns await the enterprising and patient investor.

We would love our investors to have a great experience partnering with us and so any investor who wishes to talk through any aspect further, please feel free to give us a call.

Warmly,

David Eborall

Portfolio Manager

Disclaimer

Collective investment schemes are generally medium to long-term investments. The value of participatory interest (units) or the investment may go down as well as up. Past performance is not necessarily a guide to future performance. Collective investment schemes are traded at ruling prices and can engage in borrowing and scrip lending. A Schedule of fees and charges and maximum commissions, as well as a detailed description of how performance fees are calculated and applied, is available on request from Sanne Management Company (RF) (Pty) Ltd (“Manager”). The Manager does not provide any guarantee in respect to the capital or the return of the portfolio. The Manager may close the portfolio to new investors to manage it efficiently according to its mandate. The Manager ensures fair treatment of investors by not offering preferential fees or liquidity terms to any investor within the same strategy. The Manager is registered and approved by the Financial Sector Conduct Authority under CISCA. The Manager retains full legal responsibility for the portfolio. FirstRand Bank Limited is the appointed trustee. SaltLight Capital Management (Pty) Ltd, FSP No. 48286, is authorised under the Financial Advisory and Intermediary Services Act 37 of 2002 to render investment management services.

[1] This is not a NAV discount calculation. We do not incorporate cash, debt and other investments.

[2] At the introduction of each show the ‘scientific names’ of Coyote (“Carnivorous Vulgaris”) and Road Runner (“Accelerati Incredibilus”) was stated. Source