SaltLight 3Q21 Letter 29 October 2021

As our fund has been in operation for less than a year. Under current FSCA regulations, we are not allowed to provide any performance disclosure. We are, however, allowed to disclose the following:

| SaltLight SNN Worldwide Flexible Fund Class A11 | NAV Price |

| Inception Date – 19/11/2020 (C1) | 999.17 |

| June Quarter – 31/3/2021 (C1) | 1218.13 |

| September Quarter – 30/09/2021 (A1)[1] | 1145.90 |

Dear Co-Investor

Our portfolio over the last quarter has been somewhat choppy, with little eventual movement in portfolio return. However, under the hood, quite a bit has happened. Given your and our long-term focus, these short-term price moves over a month, quarter or even a year concerning our long-term investment strategy should be of little significance.

Broadly, we saw some agreeable returns from our South African portfolio, offset by weakness from our global portfolio due to the strengthening ZAR (something we warned about last quarter) and portfolio holdings in China.

We have used the ZAR strength to our advantage by redeploying capital out of South Africa into the US, Europe, and China.

Unloved South Africa is a Lesson in Patience

Since the inception of this fund last year, the South African investments have performed marvellously. However, over the history of our firm, the fruits of these investments have not come swiftly. With much exasperation over the years, these deeply unloved SA Inc. companies have only, in the last few quarters, started to generate the kind of returns on capital that our initial analysis concluded.

It reminds us that the journey leading to above-average returns on capital is a pilgrimage filled with many spells of volatility and dependable quotation price drawdowns over time.

First, some positive highlights from the quarter

- CalgroM3 has largely been resuscitated from its near-death experience and is now demonstrating strong cash flow generation with accelerated debt reduction. As a result, we’ve trimmed our position after doubling our return on capital.

- Famous Brands has navigated multiple lockdowns, social unrest, and a challenging consumer environment to see a strong resumption in profitability.

- Purple Group (70% owner of Easy Equities) announced a retail share trading “rails” partnership with Discovery Bank. We think the economics will be like the Capitec partnership (customers acquired at zero cost), with the difference that they will have access to Discovery’s much higher-income customer base (read: higher average account value). Thus, in our view, Purple has significant optionality to grow into a scaled financial services aggregator.

We are, again, reminded that the fundamentals of these businesses never reflected what the share price declines were implying. Instead, patience and probabilistic position sizing were the key determinants differentiating between enjoying the fruits and portfolio ruin.

A long-term minded investment process dictates that a more pious and profitable pursuit is to be ‘long term greedy’ coupled with a strong stomach for volatility (we hope you will have one too).

A daily ritual on our long-term investing pilgrimage is to remove our grimy sandals, quietly recite the catechism of “financial markets are unpredictable, complex adaptive systems“, and then end off with a monastic hymn three times: “forecasting short term moves in markets is an…impossible…thing to doooo”.

Instead, we should focus on getting the big ideas right and reducing unforced errors along the arduous journey.

Time and time again, our internal data shows that we generally fare better over time by just remaining invested in probabilistic long-term “bets” and allowing portfolio construction to take care of unknown outcomes.

Today, with frothy markets and plenty of headlines to worry about, we are determined to stick to our knitting with the risk that we may be too early or too late in the short term.

(Un)Certainty in The Big Ideas

If short-term predictions are almost impossible, can we gravitate our thinking to focus on objective ideas that diminish uncertainty?

Complexity science tells us that this is simply impossible to come up with definitive outcomes in complex adaptive systems (refer to the long-term investor’s incantation above). However, one helpful avenue is to seek “certainties” or “anti-fragile” ideas about the future.

On our office wall, we have written some, what we think, highly probable hypotheses that could act as North Star ideas to filter out irrelevant noise. These are near constants (or at least with enough permanence of a decade time horizon or longer) that seem less of a leap in thinking about the future. Yet, they have resilience because, at their essence, they have considerable reinforcing momentum or, conversely, overwhelming inertia to an altering of their state.

Here are a few, and hopefully, you’ll get the picture:

- Customers want low prices, delivery speed and more selection (famously articulated by Jeff Bezos) and who will solve this?

- Computation power and data will scale non-linearly, and who will solve it?

- Human attention is finite, and who owns it?

- Education and knowledge are non-linear means of social and economic advancement.

- Humans are social storytellers and desire to become more immersed with myths, legends, and heroes.

- The physical world will persistently gravitate to digitisation as it is more productive and efficient.

Whilst these hypotheses lack specifics on who will capture these opportunities, they assist us in discounting short-term noise to focus on what will matter over the next decade.

But these ideas can often be drowned out by ‘noise’. Frothy markets and ‘fear’ headlines seem to be calling ‘time’s up’ in technology investments:

- The top 6 technology companies, so-called FAANGM,[2] represent a sizeable 25% of the S&P 500 index[3].

- High-growth SaaS[4] companies trade at record multiples that will require significant future growth to justify their valuations[5]

- Speculative mania is rife with cryptocurrencies, DeFi ideas, NFTs, ‘meme-stocks’ making the average person on the street paper millionaires.

- At the macroeconomic level, there are inflation fears negatively affecting ‘long-duration cashflow sectors like technology.

- In the US, whistle-blowers and political scrutiny raise questions of technology companies and how they police their users.

- The Chinese government has released and implemented a slew of regulatory announcements (anti-monopoly, privacy, data and cybersecurity laws).

Well, can we reorientate our gaze to the future to paint a picture of what 2028 might look like?

In Northern Hemisphere markets, most folks are returning from lengthy summer vacations. With a fresh perspective, companies usually host their “investor days” where management lays out a more detailed strategy for those with a longer-term investment horizon. After that, many market participants hastily digest management’s pitch and voice their appraisal with a buy or sell order the next day. A vote of approval receives a nice share price bump, or a nasty sell-off denotes “you’re talking b.s.“.

As we are focusing our efforts on what the world could look like in the year 2026-2028, these events are helpful to update our thinking on unit economics, competitive strategy, and management’s ‘tone’ about the future. Moreover, we try to link the new information with our broad hypotheses.

In contrast to the above ‘fears’, our broad assessment is that managers are generally quite bullish about the economy and the technology landscape.

The semiconductor sector paints a picture of the future technical capability that users will have in their hands. So, we are looking for signals whether manufacturers are investing in a category’s mass production or trialling a product for early adopters to test whether it takes off.

The semiconductor ecosystem has garnered many headlines in the recent supply chain issues, however listening to executives, the next decade appears to be highly positive. Semiconductor manufacturers must invest with five- to seven-year horizons in mind and are making huge bets on the rapid adoption of artificial intelligence, automobile technology content, data centres, 5G and IoT. If these bets work out, each of these technologies will bring new business models, software applications, and platform businesses.

Moving to software, the familiar ‘tone’ across tech businesses is that enterprise adoption is still low, and COVID has accelerated everything.

The CEO of Twilio, Jeff Lawson, in a recent letter, summed up what could be a shift in perspective that we will continue to watch. Main Street is arming itself with the tools that the large tech companies have.

Lawson contrasts the current favourable position of what he calls the Digital Giants (read: FAANGM) to Main Street[6]:

“The Digital Giants have spent years and probably billions of dollars each building their own variant of what I would call “customer engagement platforms.” It starts with the data: being able to ingest and process massive volumes of real-time data. Using that data, they build profiles of us, predicting what to promote next, and they personalize every interaction.

But when I talk to executives across nearly every kind of company, they’re asking: should I be in the shadow of the Digital Giants? Can I let them sit between me and my customers? Should I have to pay a transaction fee to keep re-acquiring my own customers from the few Digital Giants who have all the relationships? Or…should I be building my own, deep, and unbreakable customer relationships?

The answer, of course, is the latter. Every company wants to own their own customer relationships by acquiring a customer once, delighting them with their products, and earning the ability to continually expand that relationship. That’s why the entire “Direct to Consumer” world is exploding.

Great businesses know that the key to winning is to own their data, own their customer relationships, and ultimately, own their future”

Many of our portfolio companies sit on the other side of this opportunity, but we’re not yet convinced the market opportunity is a zero-sum game.

Underestimating the Coming Digitisation?

When evaluating all these nuggets of information, we ask ourselves: are market participants perhaps underestimating how transformative technology could be over the next decade?

Now, much about investing to earn above-average returns is picking your spots well.

We are highly sensitive to all the fanciful predictions made during the ‘dot.com’ era that did not materialise. In most cases, the mental frameworks of the time suggested that incumbents would successfully digitise their ‘bricks-and-mortar’ way of doing things. However, history has shown that these frameworks were lacking; incumbents were outcompeted by companies birthed in the Internet era.

The paranoia that should surface for any long-term investor in this space is that it is quite possible that what we own today will be outmanoeuvred by an upstart. We’re deeply mindful of this.

Superior Businesses from Technology

Our portfolio has gradually become more technology-heavy because when comparing tech businesses to industrial-era businesses, the software component has superior economic features compared to traditional brick-and-mortar businesses.

Firstly, pure software businesses have incredible economics (considering that bits and bytes have almost zero marginal cost).

One portfolio holding example: Cartrack[7] is a SaaS business with 70% gross margins, earns roughly 50% EBITDA margins, and grows 20%+ per annum. As a result, they need little capital to grow except for the cost of acquiring users.

Another type of business that we love is a software-enabled commodity business. In our definition, these are businesses that sell a commoditised product but layer on a software component to their model that creates a durable moat.

An example in our portfolio is SA Taxi, a business owned by Transaction Capital. SA Taxi provides commoditised loans to Taxi operators to purchase a vehicle. A few years ago, management mandated a tracking device in each financed vehicle, something traditional banks have not copied. This software layer has created a ‘data moat’ that has enabled SA Taxi to price loans better, reduce risk and become the market leader. Commodity plus software.

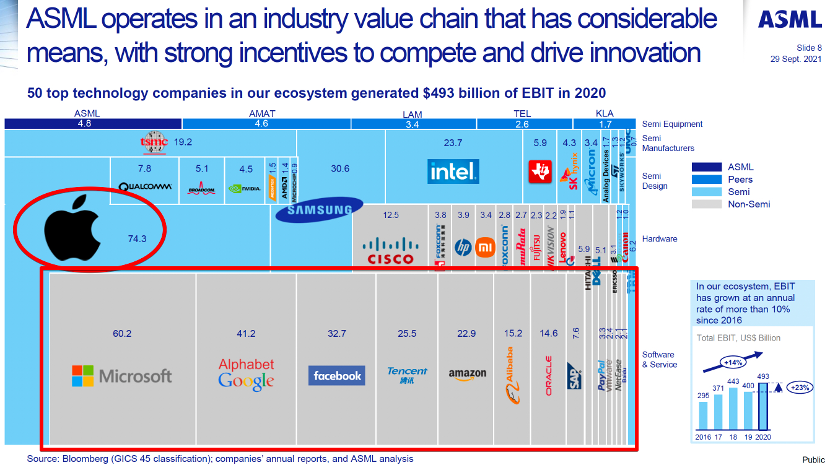

Perhaps the best way to illustrate the stronghold that “Digital Giants” have is to show who has the lion’s share of the technology profit pool. At the ASML Investor Day[8], management provided this outstanding profit pool chart from the top 50 largest global technology companies (producing roughly half a trillion dollars of operating profit in 2020 and STILL growing at a 14% compound rate over the last five years).

What is clear is that the degree of complexity does not correlate well with earning a profit. The top-level rows are the semiconductor and semi-equipment suppliers (bricks and mortar hardware of sorts). They capture a relatively small share of the pool despite the enormous revenue numbers and wide complexity moats that these great companies have.

Conversely, the software and service companies on the bottom (including Apple) capture most of the industry profit pool. Note that the chart only outlays the direct profits earned by these tech companies. It still excludes the consultants, developers and operational employees that install, maintain, and implement software and services.

Why Does This Situation Happen?

Apart from incredible software economics, when software is integrated with capital-intensive physical assets (such as logistics) or network effects (social networks), these create conditions for strong, durable moats that capture substantial value.

But when we think more deeply about software-related business models, we believe they have been allowed to play with a different set of rules to the ‘tangible’ world. The recent court battle between Apple and Epic Games illustrates our point: the case was fundamentally about Apple’s platform dominance.

For some background, Apple charges a 30% commission on any revenue earned on an iOS App (with some exceptions) that runs on an Apple mobile device. These so-called walled gardens can “tax” and “regulate” the businesses built on top of the Apple infrastructure – in perpetuity. The result is that Apple is a shameless profit-making machine (note their 15% share of the top 50’s profit pool).

The most curious outcome of the Apple/Epic Games court case, at least from our take, is that the US courts have gone ahead and re-affirmed the dominating reach of a platform ecosystem, including the discretion to monetise and place constraints on downstream ecosystem participants. Philosophically in our view, there is no nation-state, institution, bricks-and-mortar, or pre-Internet business model that has ever had this kind of favourable economic power from intellectual property.

Bits and bytes have a unique advantage with no equivalent in the physical world. It would be impossible in the physical world, where for example, Toyota could demand 30% of taxi driver’s revenue, as well as a cut of the auto insurance premium as well as commission on fuel because they’re using Toyota’s production IP to get a passenger from A to B. But in the software world, Apple can claim 30% of any game revenue earned from a user on an Apple product.

Will the Favourable Software Regime Last?

Apart from the desire from Main Street to own their customers and potential new entrants intermediating themselves between platforms and their customers[9], governments are stepping in.

Two recent events underline the increasing political and regulatory scrutiny: (1) Facebook’s (now Meta) ongoing challenge in policing its users (we wrote about our investment in Facebook last quarter here and (2) the slew of regulations announced by China. Both are relevant because they impact our portfolio.

While seemingly independent events, when we think about the patterns more deeply, they appear to coalesce around the same root issue: technology and the Internet are increasingly dominating every part of life and are intersecting with national interests.

Western governments, for now, are leaving platforms to manage themselves in a self-regulating approach, and the Chinese government is actively targeting platforms in a traditional regulatory approach. However, in the coming years, we wonder if Western Governments will converge to the Chinese path.

Government Regulation Approach

China’s regulatory thinking is, perhaps, more advanced than current western approaches. Their political structure takes a longer-term view (rather than shorter-term election cycles) of where technology is heading. They’ve decided to develop policies to rectify negative externalities that have crept in and prepare for the inevitable place that the technology assets will have – they will become national strategic assets on the same level as intellectual property and private property rights. Therefore, many of the announcements are related to data protection (and data nationalism), cybersecurity, and the increasing role of algorithms.

Overall, our reading is that (with a humble appreciation of potentially misunderstanding the genuine intention), many of the Chinese regulations have wide-ranging sensibility and a choice to focus on negating consumer harm and fostering competition.

Despite what seems like a few broken eggs, as shareholders, we must be honest: some Chinese tech companies engaged in poor behaviour.

Self-Regulating Approach

Facebook, representing half the planet on its platforms, predictably is absorbing the good and the bad of its vast user base. We have questions about who ultimately the appropriate governing authority in a digital social network should be. For us, the most perplexing aspect of the current news headlines is that society seems to have turned to Facebook to police its users and have downplayed the traditional role of a central authority to manage law and order between citizens. Up until now, policy- and lawmakers have broadly attempted to contain negative externalities through the means of industrial-era anti-monopoly law.

Will Increasing Regulations Affect Our Portfolio?

We have found over the years that regulatory announcements are always an initial shock. However, when the dust settles, the headlines dissipate, and the affected companies adapt; regulations have tended to favour incumbents as they have the resources to survive and perhaps thrive in a regulated regime. The operational bar is raised for new entrants to play in the space.

Now, putting this all together: we think there are heightened risks with pockets of frothy markets that can always spill into general equities. Some ‘fears’ are warranted in the short term and could result in a similar reaction to what happened to Chinese technology stocks over the past quarter.

Hopefully, we’ve made the case that we are focusing on what the world could look like in 2028.

Back to our original question: could we be perhaps underestimating the heightened pace of digital transformation that COVID-19 has catalysed?

Sometimes, we hear something that gets us thinking:

In July this year, the CEO of Microsoft, Satya Nadella, was asked how much growth could be left after their multi-year success. Nadella responded:

“Thanks so much, Keith, for the question.

I mean the way we see the results today reflect that but, more importantly, on a secular basis, as I think about it – I always go back to that number, which is 5% of the world GDP is tech spend, it’s projected to double. I think that doubling will happen at a more accelerated pace.

And we feel well-positioned because of the innovation across the stack because, if you think about it, what’s going to happen is every business, whether you’re a retailer or a manufacturer, in the service sector, public sector or private sector, digital adoption is the way you’re going to be both resilient as well as transform the core business processes.”[10]

Now, we don’t know where Nadella’s forecast comes from, but it’s worth playing with some of his numbers. The fun fact is that World GDP (nominal US$ at 2020) is around $85trn[11].

Over the last four to five decades, technology spending has indeed ramped up to 5% of global GDP, equating to an astounding $4.25trn spent a year across technology replacement, people, software, and hardware.

(We’ll leave it to the economists to question if GDP adequately captures the actual productivity gain or value loss to the GDP figure from the substitutive effect of a Zoom call with a client vs an expensive business trip to meet the client in person).

IF Nadella is even directionally correct, there are trillions of dollars of opportunities still to come. With our investment process, we’ll endeavour to deploy your capital to capture this opportunity set.

Regulations in various forms in China and Western markets are almost a certainty. However, we downgrade the long-term impact for incumbents and believe that healthier platforms will foster more growth and more businesses built on top of technology.

We’re incredibly excited about what is to come, and we hope that you’ll continue to join us on this journey.

As always, please feel free to get in touch with us should you have any questions. We always remind co-investors that most of our liquid wealth sits in the same fund as yours. We, therefore, share in the ‘ups’ and inevitable ‘downs’ alongside you.

Warmly,

David Eborall

Portfolio Manager

Disclaimer

Collective investment schemes are generally medium to long-term investments. The value of participatory interest (units) or the investment may go down as well as up. Past performance is not necessarily a guide to future performance. Collective investment schemes are traded at ruling prices and can engage in borrowing and scrip lending. A Schedule of fees and charges and maximum commissions, as well as a detailed description of how performance fees are calculated and applied, is available on request from Sanne Management Company (RF) (Pty) Ltd (“Manager”). The Manager does not provide any guarantee in respect to the capital or the return of the portfolio. The Manager may close the portfolio to new investors to manage it efficiently according to its mandate. The Manager ensures fair treatment of investors by not offering preferential fees or liquidity terms to any investor within the same strategy. The Manager is registered and approved by the Financial Sector Conduct Authority under CISCA. The Manager retains full legal responsibility for the portfolio. FirstRand Bank Limited is the appointed trustee. SaltLight Capital Management (Pty) Ltd, FSP No. 48286, is authorised under the Financial Advisory and Intermediary Services Act 37 of 2002 to render investment management services.

[1] During the September 2021 quarter, the primary reporting class in the SaltLight SNN Worldwide Flexible Fund switched from the C1 class to the new A1 public class of units.

[2] Facebook, Apple, Amazon, Netflix, Google, Microsoft

[3] Yardeni Research, 19 October 2021, https://www.yardeni.com/pub/yardenifangoverview.pdf

[4] Software as a Service

[5] 31.9x on an EV/NTM Revenue valuation basis; high growth is considered greater than 30% NTM growth. Source: Clouded Judgement 10.15.21 link

[6] Source: Twilio 3Q2021 Earnings, source

[7] Now formally publicly listed as Karooooo (with five zeros)

[8] Source: ASML 2021 Investor Day, Company Strategy Presentation, source

[9] Something like “Olo” is a point-of-sale platform that has intermediated between Food Delivery aggregators and restaurant merchants

[10] Microsoft Earnings Call Transcript 4Q21

[11] Source: World Bank, https://data.worldbank.org/indicator/NY.GDP.MKTP.CD