Meerkats and Marketplaces

3 February 2022

| SaltLight SNN Worldwide Flexible Fund Class A1[1] | Return |

| Since Inception – CAGR | 18.69% |

| December Quarter – 31/12/2021 (A1) | +4.96% |

Dear Co-Investor

This marks the end of the first full year of the fund’s operation. The SaltLight SNN Worldwide Flexible Fund A1 class returned +4.96% during the quarter and since inception, the A1 class has returned 18.69%[1].

Individual classes may differ in performance depending on fee structures, investor entry points and when the unit classes were created.

Change and Chaos

If we had to summarise our perception of the first two years of the 2020’s decade, our impulse is to go with: change and chaos.

Without stoking too much angst, the rest of the decade is shaping up to encompass more… change and chaos. The world will face, among many other challenges, the rapid adoption of new technologies (artificial intelligence, genomics, and digitisation), a zealous energy transition and the crushing load of sovereign debt across nations. We don’t know what the outcome of all these intersecting forces will be in 2030.

This scene is unnerving and enthralling. We have found that investment opportunities lie in the heart of ambiguity (just look at the variance of fortunes won and lost during the last two years).

Amidst this impending change, we do have some confidence in one idea: industry structures are going to continue to morph into ‘winner-takes-most’ patterns. AI will create more concentrated monopolies where many traditional industry incumbents will fight to be relevant against an algorithm that can solve a problem better, cheaper, and faster. Without data, scale and skills, incumbents are going to be pushed into a small corner where human capabilities can still compete.

We believe that the right attitude is to embrace this change and chaos. To prepare for it. To adapt with it. To learn from it.

Our aim in these letters is to invite the reader to sit in the armchair next to us. To give our perspective on subjects with some longevity as opposed to commentary on the here and now. We, unfortunately, can offer little prophetic value in forecasting what markets will do in the short term.

The last quarter turned out to be a modestly volatile quarter for the fund. For some market participants with shorter time horizons, there is much doom and gloom: bubble fears, inflation fears, interest rate fears, supply chain fears and not to forget, COVID fears. We’d caution investors to not let their heart rates go up too high. For participants with longer time horizons, these blips in time offer wonderful opportunities for the patient.

In this letter, we talk about how SaltLight is positioned to adapt to this longer-term change and chaos. We then spend quite a bit of time talking about a business model that leads to a ‘winner-take-most’ setup. We use the example of an e-commerce marketplace however the principles can be abstracted to apply to social media platforms, food delivery, gig work, user-generated content and even credit card processing.

A Focused Strategy

One of the reasons why we think and act differently from our peers is that, at SaltLight, we do not swear fealty to indices. Instead, we pay homage to earning real returns above inflation. In an act of sedition, we think that the path to above-average returns is to own the world’s most durable and indispensable companies for long periods.

If we’re right that more industries will consolidate into ‘winner-takes-most’ configurations, the investment landscape will bifurcate into a few ‘winners’ and a large pool of ‘losers’. By deduction, future investment returns will be dictated by a few winners and a large number of losers in this transition. The large weightings of certain technology companies in major indices are an omen to the transition underway (FAANG in the US, China Tech / Naspers on the JSE).

To improve our odds of benefitting from this transition, the most value-adding input to our process is to learn what to say “no” to.

Our controversial approach is that we only invest in three types of businesses modalities in our “resilience and optionality” allocation (roughly 60%-70% of the portfolio). We believe that these three modalities tend to offer the greatest odds of picking businesses that become durable and indispensable (and, yes, some will be victorious in the ‘winner takes most’ battle)[2].

In some of our portfolio companies, these characterisations are clear today (just ask their customers, suppliers, and broad ecosystems). Gradually, we’re making probabilistic bets on businesses that have the potential to become durable and indispensable companies over the next decade.

Marketplace Model

We wanted to perhaps give a simplistic example of how long-term value is created in one of our favourite business models: marketplaces. We will leave it to readers to judge whether all the short-term angst above is warranted.

Due to the structural advantages of the marketplace model, the industry typically amalgamates into one or two leaders who monetise the most value (i.e., “winner-takes-most”) and a long tail of ‘just surviving’ competitors.

Identifying leaders early is particularly challenging. More so than evaluating who will be a leader in, say, an industrial business.

But what signals can an investor use to identify possible ‘winners’?

Our observation is that even smart, knowledgeable investors, whom we greatly admire, struggle to grasp how long-term value is created in these businesses and hence their arduous journey to recognised leaders is filled with disbelief, doubt, and share price volatility.

To many, they’re unprofitable and only exist at the pleasure of ‘cheap capital’. We hope that by the end of this letter, readers will see that this perspective misses the longer-term picture by a mile.

(For reference, the marketplace model echoes across our portfolio companies in disparate geographies and stages of maturity).

What Are Marketplaces?

To state the obvious, digital marketplaces facilitate value exchange between two or more parties. Abstractly, a marketplace has a ‘consumer’ and a goods or service ‘producer’. In our example, we’re going to use an e-commerce marketplace that facilitates transactions between buyers and sellers.

To hone in on the investment differentiation, we are going to contrast investing in a marketplace with an industrial business.

Our view is that, at scale, marketplaces are insanely profitable, requiring little incremental capital to operate and can produce exceptional amounts of free cash flow.

If so, why is there so much “disbelief, doubt and volatility” if marketplaces are such good investments?

There are three possible reasons that we observe:

- It takes a long time to scale (more than a decade).

- Economic value is not easily observed until very late in the lifecycle of the business

- Growth and scale are non-linear and therefore generally underestimated

The Industrial Business

First, let’s contrast a marketplace with an industrial business.

Industrial businesses are easily understood:

- A shorter path to scale and profitability (requiring shorter investment time horizons +/- 5 years)

- Economic value is easily measured in the accounting records early on

But industrial businesses are subject to the laws of the physical world and therefore growth and scale do not always translate into higher incremental returns on capital. What we mean by this is that a dollar of capital invested in year 5 will earn a lower return than a dollar of capital invested in year 1.

A Shorter Path to Scale and Profitability Requiring Shorter Investment Horizons

An industrial, let’s say, widget-making entrepreneur, would have to source capital to build a factory, equip it, staff it and have enough of a cash buffer to cover production and operational expenses until the factory scaled up to maximum production volume. Once scaled, the business hopefully earns a sufficient return on capital employed.

Most business plans of this type operate with five-year time horizons.

Economic Value is Easily Measured in the Accounting Records Early On

The accounting rules provide a favourable picture for industrial businesses such that an investor can reconcile economic value creation to accounting value throughout the life stages of the business.

What the accounting rules get right is they understand that the factory will produce economic benefits over an asset’s lifetime and therefore, in the income statement, the large upfront capital expenditures are spread over many years (called depreciation). The result is that profits are demonstrated earlier in the life of the business.

But, Growth and Scale Can Lead to Diminishing Returns on Incremental Capital

As the business succeeds and sells more widgets, profitability improves linearly because of operating leverage. Variable costs grow in tandem with production volume, but fixed capital and operating costs are spread across more widget’s being produced.

However, once production goes beyond the factory’s capacity, our entrepreneur needs to build a new factory, raise more capital to fund it and go through the profitability curve all over again.

Growth is a mixed blessing for the physical world business. On the one hand, profits are growing on an absolute basis. But each time, growth requires new capital and increasingly complex organisation layers. If the business needs to grow outside its region, complexities around logistics, time and space create additional friction to scale. And so, academics would call these diminishing returns.

From an investor perspective, these businesses tend to have multiple regional competitors, can be easily displaced by cheap foreign competition, and have declining returns on incremental capital.

The Internet Platform Business

Whilst industrial businesses are limited to the physical world, the Internet has fewer tangible constraints and can operate on a global scale in a somewhat transcendental manner.

Entrepreneurs learned from the dot.com crash that is better to be a ‘connector’ rather than a ‘producer’ (let somebody else go through the industrial business problems). Connectors are also more resilient because the risk is defused amongst thousands or millions of users.

A connector has substantial advantages: (1) it can grow into significantly larger opportunity sets and (2) it scales non-linearly.

But it takes longer to get there and investors struggle to identify where economic value is being created until the very late stages of the platform’s maturity.

A Larger Opportunity Set

Bits and bytes are mutable and easily managed. Atoms are constrained and require widespread operational involvement.

Connectors are not tied to one product (widgets) or a physical constraint (geographic regions) or require large bureaucracies to operate. Connector’s play a role of a ‘benevolent autocracy’ that rule via software code. Their relatively small employee base facilitates billions of gross merchandise value, and as they expand, they can easily update code to start selling cars in addition to widgets.

Comparably, an industrial business would have to refactor its entire manufacturing process and supply chain to switch to a new product type. As they grow, they require deep managerial, operational, and manufacturing infrastructure to produce more.

Naturally, the opportunity sets are smaller for industrial businesses.

Non-Linear Scaling Effects

Both models face a high capital intensity in the startup phase. The differences are apparent when evaluating 10x growth scenarios for both models.

In the marketplace, growth from, let’s say, 1m users to 10m users has the highest capital intensity until the business generates network effects (we’ll dive into this later). Once the business hits a tipping point[3], the value created through the network effects becomes self-sustaining. Growth capital intensity drastically reduces in the next phase of growth from 10m users to 100m.

Conversely. a 10x growth for an industrial business will require several reorganisations of the operation, large capital injections and, as mentioned, potentially diminishing incremental returns on that capital.

Up to this point, we think most investors who’ve been around in the internet era would appreciate the structural benefits of a platform relative to an industrial business. We doubt that we have brought any profound insights to the table.

Back to the question: why is there then so much “disbelief, doubt and volatility” if marketplaces are such good investments?

We observe that there are three possible reasons:

- It takes a long time to reach scale (more than a decade).

- Economic value is not easily observed until very late in the lifecycle of the business

- Growth and scale are non-linear and therefore generally underestimated

It takes a long time to reach scale

Stating the obvious, connectors need a healthy depth of buyers and sellers to create economic value. But there is a ‘chicken and egg’ problem (more technically the two-sided market problem) at inception. Buyers won’t join because there are insufficient sellers, and sellers won’t join because there are insufficient buyers.

But as both sides join, the value is increased for all network participants. These are network effects.

We’re going to dive deeper here because we think that understanding how scale is reached might offer the ‘why’ to misunderstanding these investments.

Scaling to Achieve Network Effects

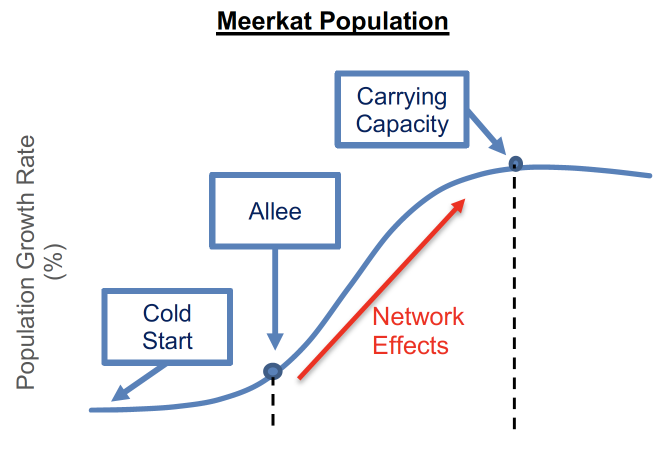

This process is somewhat magical and a business with end-state network effects has incredible advantages. We thought it would be helpful to give our learnings on how network effects unfold by discussing: (1) how network effects are created, (2) generating liquidity and (3) engaging users after the post-Allee Threshold.

1) How Network Effects Are Created

One of the best explanations we’ve found on the mechanics of creating network effects is in Andrew Chen’s “The Cold Start Problem: How to Start and Scale Network Effects”[4].

Chen uses the analogue of Meerkats, who by being social animals, self-organise into mobs by sticking around each other. The parallels to platform businesses will hopefully become apparent.

- Cold Start Stage: A pair of Meerkats who need to keep safe, find food and reproduce to survive.

- Allee Threshold Stage: There is strength in numbers as a larger group of Meerkats permits higher aggregate and individual safety where some members of the group can warn others of dangers. Chen describes a biological science concept called the ‘Allee Threshold’ where sufficient individual Meerkats join to provide overall group safety. However, if the Meerkat group does not grow enough to the Allee Threshold, predators start to pick off members one by one and the group quickly dwindles.

- Network Effects and Tipping Point Stage: Past the ‘Allee Threshold’ the daily life of an individual Meerkat gets safer and finding food becomes easier. As a result, population growth accelerates, and the group becomes self-sustaining.

- Carrying Capacity Stage: As reproduction starts to accelerate the size of the group, the ecosystem (food, water, physical space) starts to struggle from overcrowding. Overcrowding can lead population growth to taper and even go negative. Therefore, either the group needs to seek larger, greener pastures or there will be a natural ceiling to group size.

Now, let’s apply these principles to platform-driven networks. Initially, to grow the network from zero buyers and sellers (Cold Start Stage) to the Allee Threshold Stage, the platform needs to artificially drive initial interactions between both sides of the network. This is called generating ‘liquidity’.

Usually, one side of the network is harder to attract than the other as it provides disproportionately more value. In a marketplace, it is the sellers who won’t join unless there are sufficient buyers. In a video sharing platform, consumers are attracted by talented creators. There is a power distribution of creators where top creators offer disproportionate value relative to average creators. These gems are very difficult to find.

We’ll get into how the marketplace generates demand a little later. But once initial buyers and sellers are added through liquidity facilitation by the platform, the network needs to reach the Allee Threshold.

Once, the Allee Threshold is reached, there is a tipping point, and the network becomes self-sustaining because network effects start to develop. From this point, as more buyers and sellers join, each adds value to all the others. Buyers start to recruit their friends (without the need for pre-Allee incentives). Sellers see all the buyers joining and start to list more categories of SKUs.

User growth is non-linear at this point and the aggregate network effect value is also scaling non-linearly. When appropriate, marketplaces can start to dial back the incentive levers to buyers and sellers (at some point, sellers need to be on the platform to access such a large customer base).

Depending on the competition, value creation and other factors, the marketplace can now start to monetise the value from ‘connecting’. Beyond a commission, they could also introduce advertising, logistics, payments, and other new categories to offer a wider selection.

As with Meerkats, there can be a carrying capacity: too many ads, spam, poor service, long delivery times and incrementally worse sellers can all offset growth in the network. The Marketplace needs to continuously increase carrying capacity to keep the network growing.

2) Generating Liquidity

Marketplaces must overcome the two-sided problem from Cold Start (zero buyers and sellers) to the Allee Threshold by generating liquidity. There is strong inertia in the early stages that requires offsetting momentum. Energy and capital are the only controllable tools and then luck and timing play a role too.

There are countless ways to generate liquidity on platforms but in marketplaces, the first goal is to get a buyer to try the app/website. The succeeding goals are to buy…and then buy again and again.

Retention loops (product reviews, next purchase discounts etc) take the buyer on a journey from ‘trier’ to ‘habitual buyer’.

At all stages, friction should be culled to lessen churn and preserve the lifetime value of the user.

Buyer acquisition

Buyer acquisition relies on a funnel. The predominant (and most expensive) method is to advertise on typical platforms. Alternatively, there are more capital-efficient methods used by some platforms where they leverage their existing user bases or make a deal to use another platform.

- Advertising: To find buyers, the platform usually raises a bunch of venture capital and spends a large proportion of it on internet advertising (SaltLight owns Facebook and we’re first in line to capture venture capital spend). User acquisition from advertising has become a very competitive and expensive business[1].

- Astonishingly, only a single-digit percentage of users who install an app go ahead and order something.

- Use other networks: In China, Tencent (a portfolio company) made investments in early-stage platforms and offered preferential access to its social media network for the privilege. This gave the startup access to hundreds of millions of potential Chinese customers at a low acquisition cost.

- Use existing user base: But what if the platform had another business where they had millions of customers (say playing games)? If the marketplace could nudge a percentage of these gamers to try the app, they would not need to raise so much venture capital nor would they have to pay it all to Facebook or Google.

- SEA Ltd (portfolio company) leveraged its large gaming platform by offering a ‘virtual good’ (i.e., zero marginal cost) to a gamer if they try their marketplace app (Shopee).

Incentives

Now, once the buyer visits the app or website, the marketplace needs to make a deal that the buyer cannot refuse. They offer, say, free shipping and a 10% coupon for the next order (retention loop) as an example. The sellers see real order flow and start to load their other products.

Before the Allee Threshold, it makes sense to not charge a commission to the seller and therefore platform earns little revenue to offset the cost of generating liquidity.

This simplistic example is the intangible process of network effects being created. After, say, ten successive purchases, now our Gaming customer visits the marketplace out of habit when they’re looking for something.

The Marketplace starts withdrawing free shipping and the buyer doesn’t care, they just love the growing selection of products, quick deliveries, and, of course, low prices.

3) Engaging Users After the Post-Allee Threshold

Once there are sufficient buyers and sellers, the network starts to become self-sustaining. The job of the marketplace is about retaining these networks and growing into new ones.

We’ll often listen to potential investees to see what KPIs [7] they care about. Many will promote metrics around average order sizes or the number of user accounts that they have. We have found that the best marketplace management teams focus on engagement (order frequency, engagement time and activity metrics).

As we have mentioned in previous letters, the most finite constraint today is attention. If a user is engaging in your app, they’re not spending time on another (or ordering from the competition). Habits are developed from engagement.

We’ve been very impressed with some of our portfolio companies and what they focus on. SEA Ltd uses its background in gaming to gamify the shopping experience. In the US, Amazon introduced Prime (free 2-day shipping, Prime Video and Prime Music) resulting in a highly engaged customer base.

All these retention loops create a longer lifetime value and potential to earn revenue where the customer acquisition investment has already been made.

Building Network Effects Requires Patience

It takes a long time to build these network effects and realise profitable cashflows, certainly longer than an industrial business. Some network effects are hyper-local (for example food delivery is a city-scale network of customers, drivers, and restaurants) and others are national or worldwide. The Allee Threshold size is dependent on the nature of the network. But the time and expense result in a durable competitive barrier from new entrants.

Throughout our discussion, we’ve ignored the actions of competitors who are jostling for the same buyers and sellers. The quality of management’s execution is an important determinant because some grow users at all costs, others acquire users but can’t retain them. Some are brilliant at reducing friction, creating logistics efficiencies or simply focusing on the execution of hard elements that are considered norms.

Our experience is that scale and profitability take at least a decade. The size of a sustaining network, levels of external competition and strength of network effects directly affect the pace of monetisation.

Economic Value is Not Easily Observed Until Very Late in the Lifecycle of the Business

To recap:

- Accounting value is the value of a business recorded in financial statements.

- Economic value is the intrinsic business value. Warren Buffett says it is all the cashflows between now and judgement day, discounted at the proper discount rate[1].

Not Considered an Investment

We outlined above how it is easier to reconcile economic value and accounting value in an industrial business. Conversely, the accounting rules do not see user acquisition costs or incentives that develop network effects and habits as an investment like a factory would be seen.

For industrial businesses, rules such as depreciation and amortisation allow capital expenditure to be ‘expensed’ over the economic life of the asset. Therefore, profits appear, at least from an accounting perspective, earlier than viewing it from a cash flow perspective.

Investors tend to value companies on accounting value and therefore, at a much earlier stage, attribute value to an industrial business.

The accounting picture for a marketplace is not as easy. If a platform raised capital and then used it to buy advertising to acquire users or provide incentives[9], that ‘investment’, would be expensed on day 1. The accounting rules do not spread the expenditure over the economic life of a user even though the platform could derive economic benefits over a much longer period.

Should an investor pick up the accounting records in a pre-tipping point stage (or if the marketplace is rapidly expanding), the business would show exponentially growing losses growing. Exponentially because these costs follow users growth and platforms scale users non-linearly.

No Accounting Value for Network Effects or Habits

The greatest challenge that we see in using accounting records is that the primary element of economic value creation is not recorded. As the company moves from Cold Start to the Allee Threshold to the Tipping Point, the accounting rules have no method of recording the incremental value that is being created by network effects or the developing user habits.

The time to monetisation also makes it difficult because revenues can only show up much later in the life stage of the business. It is counterintuitive but at this point, the marketplace has probably already captured a significant relative market share. It also means that incentive levers have been turned down drastically and so when revenue shows up, it shows up quickly as profits.

We’d argue that economic value had been created much earlier than before revenue or profits showed up. The accounting rules simply don’t adequately capture the reality. To an investor relying on them, they’re making decisions at very late stages of growth (and missed investment returns).

Growth and Scale are Non-Linear and therefore Generally Underestimated

Digital platforms have many more levers for growth and durable value creation than an industrial business. Brian Arthur’s seminal paper on Increasing Returns[10] describes how network effects are perhaps the most underestimated competitive advantage available – in summary: the stronger get stronger.

If platforms have engaged users, there are unbounded avenues to solve incremental problems for these users without the cost of acquiring them.

The user base is an abstract multi-purpose asset and therefore to develop new growth opportunities, the marketplace can leverage its user base and infrastructure to offer logistics, financial services, last-mile delivery, media content and even cloud services.

Winner Takes Most

This has been a long journey to getting to a ‘winner-takes-most’ end state for a business and the opportunity set it is tackling. But, that golden, profitable pot can take a long time to be reached.

Wrapping this up. We believe that the long-term outlook for ‘winning’ marketplace models is highly attractive. At scale, these businesses are hyper-profitable and require little incremental capital to maintain that profitability. Our portfolio has the platform model dotted across it. Some of these businesses are at the pre-Allee stage. Others are at scale and are highly profitable.

Whilst there is a gap between economic and accounting value, there will be a gap in investor perceptions of the value of these businesses. The result is that the share prices of these portfolio companies could be highly volatile as markets struggle to digest long periods of losses.

We think that an investor needs to understand what stage a business is in to appropriately assess whether the accounting records are relevant in establishing value.

We’re incredibly excited about what is to come, and we hope that you’ll continue to join us on this journey.

As always, please feel free to get in touch with us should you have any questions. We always remind co-investors that most of our liquid wealth sits in the same fund as yours. We, therefore, share in the ‘ups’ and inevitable ‘downs’ alongside you.

Warmly,

David Eborall

Portfolio Manager

Disclaimer

Collective investment schemes are generally medium to long-term investments. The value of participatory interest (units) or the investment may go down as well as up. Past performance is not necessarily a guide to future performance. Collective investment schemes are traded at ruling prices and can engage in borrowing and scrip lending. A Schedule of fees and charges and maximum commissions, as well as a detailed description of how performance fees are calculated and applied, is available on request from Sanne Management Company (RF) (Pty) Ltd (“Manager”). The Manager does not provide any guarantee in respect to the capital or the return of the portfolio. The Manager may close the portfolio to new investors to manage it efficiently according to its mandate. The Manager ensures fair treatment of investors by not offering preferential fees or liquidity terms to any investor within the same strategy. The Manager is registered and approved by the Financial Sector Conduct Authority under CISCA. The Manager retains full legal responsibility for the portfolio. FirstRand Bank Limited is the appointed trustee. SaltLight Capital Management (Pty) Ltd, FSP No. 48286, is authorised under the Financial Advisory and Intermediary Services Act 37 of 2002 to render investment management services.

[1] From inception to 12/07/2021 the C1 class was used for performance. Thereafter, the A1 is the core class used for performance.

[2] We still achieve considerable diversification because these modalities exist in different industries and geographies.

[3] Each model will have a different tipping point and we’re simply using these user base numbers to make the maths easy.

[4] The Cold Start Problem: How to Start and Scale Network Effects, Andrew Chen, link

[5] Allee Effect definition per Wikipedia: The Allee effect is a phenomenon in biology characterized by a correlation between population size or density and the mean individual fitness (often measured as per capita population growth rate) of a population or species.

[6] In 2021, the average cost per install of a mobile app in North America was $5.28. The average cost per action for Facebook was $21.47 and $45 for Google Search. Source

[7] Key Performance Indicators

[8] Warren Buffett: How to Calculate Intrinsic Value, https://youtu.be/Bxqre8vPYBo

[9] Incentives can be real cash outflows (free shipping) and foregone income (zero commission or coupons).

[10] Increasing Returns and the New World of Business, Brian W. Arthur, https://hbr.org/1996/07/increasing-returns-and-the-new-world-of-business