3 February 2023

Dear Co-Investor

SaltLight SNN Worldwide Flexible Fund (Class A1)

| Period | Return |

|---|---|

| 2020 (starting 11 November 2020) | +3.42% |

| 2021 | +18.09% |

| 2022 | -34.46% |

| *** 1Q | -22.50% |

| *** 2Q | -1.21% |

| *** 3Q | -10.10% |

| *** 4Q | -4.78% |

In this second completed year of our flagship fund, the purpose of these letters is to inform our co-investors about what we are trying to achieve and how are we trying to do it.

The ‘what’ is static, our primary objective is to offer exceptional returns. The ‘how’ can be broken into mutable and immutable activities because the journey to get there is dependent on an unknown path with multiple possible outcomes.

Last year was a challenging year across geographies and asset classes with significant volatility in the asset prices of our portfolio companies. The temptation is to pursue a mutable investment strategy. Flipping between aggressive (fully invested, high equity) and defensive (high cash levels, redeploy capital into ‘safe’ and well-known businesses while waiting for the storm to pass) strategies, often fighting the last war.

We must admit, investment managers pursuing this strategy sound highly intelligent and perhaps they’re objectively successful at it. However, we don’t believe that we have a high probability of getting the entry or exit right each time.

We prefer to follow the immutable strategy with two key ingredients: (1) an investment framework for identifying outstanding opportunities and (2) a set of behaviours as inputs that will deliver exceptional return outputs.

While we have discussed our investment framework in previous investor letters, this time we would like to focus on the behaviours that differentiate our approach and thread them into our portfolio investments.

At the end of the day, investment frameworks are an upfront activity that takes time to play out, good investment behaviours require daily incantation and ritualisation. We need ideas to hold onto whilst going through the dark valleys as well as the bright peaks.

We believe that the ideas of being deliberately entrepreneurial, deliberately persistent, and deliberately extreme are how we aim to generate exceptional returns.

Being Deliberately Entrepreneurial

At the outset, we think that there is an unmistakable correlation between investing and entrepreneurship. The economic outcomes are both interconnected and even Warren Buffett said this about his success: “I am a better investor because I am a businessman, and a better businessman because I am an investor”.

Our experience of being entrepreneurs has certainly influenced how we invest. We have been through the journey of value creation, the setbacks and the successes, the challenge of overcoming economic inertia and the stamina needed during challenging periods.

This experience feeds into the types of companies we invest in, their corporate cultures and the nature of the investment journey that we are prepared to go on. In short, we are prepared for the rockier, less established, road whereas we know that most of our industry prefers a well-demarcated highway.

Be Deliberately Persistent

Our experience is that often an opportunity requires tremendous persistence. A more recent example is our portfolio investments in China. During the whole of 2022, this had been an incredibly trying country to have exposure to.

In our 3Q22 letter, we lamented about our exposure to China:

“Now some of our investments have not gone according to plan (well…yet). Our portfolio investments in China (~10% of the portfolio) have been significant detractors to performance. The recent regulatory headwinds seem to have calmed down and on the current facts, we think there is a low probability of an imminent invasion of Taiwan

… The Chinese Government’s COVID-Zero policy has been the strongest blow to our investment thesis.”

We reasoned that this was a setback:

“If we cast our minds beyond a few quarters, we cannot see how the Chinese government can keep the country locked up and maintain its national ambitions.

Everything about this setback seems to us like a short-term obstacle rather than a structural reason to sell our investments. Meanwhile, our portfolio companies are trading at historically low multiples. China sentiment is at an absolute rock bottom.

If we apply some moderate probabilities of a policy change, we could see substantial investment returns in future years.”

Not long after our letter, China did indeed introduce some major policy changes:

- Relaxed its ‘Dynamic COVID’ policy

- Eased the ‘Three Red Lines’ policies relating to the property sector and lastly,

- Agreed to audit inspections of US-listed Chinese companies which could have resulted in the delisting of these companies from the US.

The change in sentiment has been quite remarkable. Here are two headlines from the South China Morning Post (a reasonably balanced Asian publication) a few months apart:

15 March 2022: JP Morgan Calls China Technology ‘Uninvestable’

18 January 2023: SCMP Article About Strong Foreign Investor Inflows

We’re hesitant to call any victory yet because anything can happen with China. But our initial persistence seems to have paid off. The primary uncertainties have retreated and since the date of our 3Q22 letter to the date, Tencent is up 63%, Pinduoduo (+ 48%) and Prosus (+50%) to name a few.

Being Deliberately Extreme

Another behaviour that we believe is helpful is being intentionally extreme. Clayton Christensen talked about three approaches to creating new-growth businesses: 1) sustaining innovations, 2) low-end disruptions and 3) new-market disruptions.

Most businesses simply modify existing ideas with slight improvements (sustaining innovations) or expand them into new markets. However, a select few businesses generate significant business value by tackling complex, uncertain problems with wide potential outcomes at the edge of possibility, even if success is uncertain.

We love how, James Anderson, the retired manager of the extremely successful Scottish Mortgage fund recently put it:

“The first topic is that we think it’s quite clear that you should live life in the extremes; investment performance is a matter of capturing the extraordinary. The extraordinarily successful. The extraordinarily great. The extraordinarily unusual.”

Anderson goes on to say:

Most companies do not matter at all and, do not, over the long term, produce returns. And that transcends the divide between value and growth. We are just as uninterested in the average growth company as we are in the average value company. We’re interested in the companies that [..] scale in their markets and scale up their returns. [These] can produce those extremes of performance.”

The thought that “most companies do not matter at all and, do not, over the long term, produce returns” haunts us. We have mild paranoia that we continually ‘raise the bar’ of our portfolio to ensure that we own the businesses that matter.

Compared to our peers, we have an advantage as we are not compelled to invest in mediocre companies like those who follow a benchmark strategy. They may be required to invest in average businesses simply because they are part of a benchmark or market index.

Investing in unconventional opportunities can be a lonely pursuit, with the potential to be ahead of the curve, fall short of expectations, or appear foolish. It’s easier to follow popular opinions and invest in established companies like Microsoft, Nestle, or Starbucks, where the risk of looking foolish is low.

Businesses are often perceived as misguided or speculative ventures during their early stages, and their journey can follow a pattern of being ignored, mocked, opposed, and eventually accepted. Market sentiment and cycles play a role in this pendulum of doubt and belief, much like Gandhi’s famous quote, “First they ignore you, then they laugh at you, then they fight you, then you win”.

Entrepreneurs must fully commit their resources from the outset without any guarantee of success. Investors, on the other hand, have the advantage of being able to gradually invest smaller amounts of capital and increase their investment as the company performs or the opportunity evolves. We’ve used this incremental capital strategy with some of our ‘early-stage’ investments such as Roblox, Purple Group, Transaction Capital and Karooooo (Cartrack).

Today, we would like to discuss one of our early-stage investments, Roblox. While there is a risk that we may be premature, mistaken, or even wrong in our evaluation of this opportunity, we see Roblox as a company with the potential to ‘matter’.

Roblox is a 3D real-time content platform that bridges consumers and creators[1]. Instead of being a conventional gaming product, Roblox acts as a tool provider that democratises the creation of 3D real-time user-generated content (UGC).

What exactly is ‘3D real time’ and what is user-generated content?

The term 3D real-time content may seem complex, but it simply refers to a three-dimensional digital environment that is dynamically rendered in real-time. To put it in perspective, 2D images and videos are limited, static representations of an event captured in 2D. They lack context and physical properties[2]. On the other hand, 3D objects in the Roblox world have context and properties[3] that allow for interactive experiences that mimic the real world. These objects are generated in real-time through programming code.

Think of it as the difference between a scanned PDF image and an editable Microsoft Word document. The scanned image is passive and cannot be edited, while the Word document is editable and has font and style properties.

Real-time content involves more human actions and senses, making it a more memorable and higher-order experience compared to passive forms of media such as photos and videos.

User Generated Content (UGC)

The entertainment industry operates on a fundamental principle of exchange between the consumer and the content creator. The consumer provides their attention in return for engaging content, and the content provider monetises this interaction through advertising or other means.

Unlike traditional content creators, Roblox does not produce content but instead provides the tools for creators to do so. This has several benefits, including having a broader and more diverse range of content and not having to invest in potentially unsuccessful content.

Roblox’s combination of 3D real-time and user-generated content offers a much more dynamic and interactive experience than other content mediums today, making it a strong contender in the competition for attention.

A Sci-Fi Investment Thesis?

Despite potential scepticism, we firmly believe in the potential of Roblox as a promising investment opportunity. The platform already boasts a substantial user base, with an estimated 250 million monthly active users from the Gen Z and Millennial generations and nearly half of all children in the US are believed to be active on the platform.

Additionally, data shows strong daily engagement with the average daily active user spending 2-3 hours on the platform, which is comparable to the TV viewing habits of previous generations.

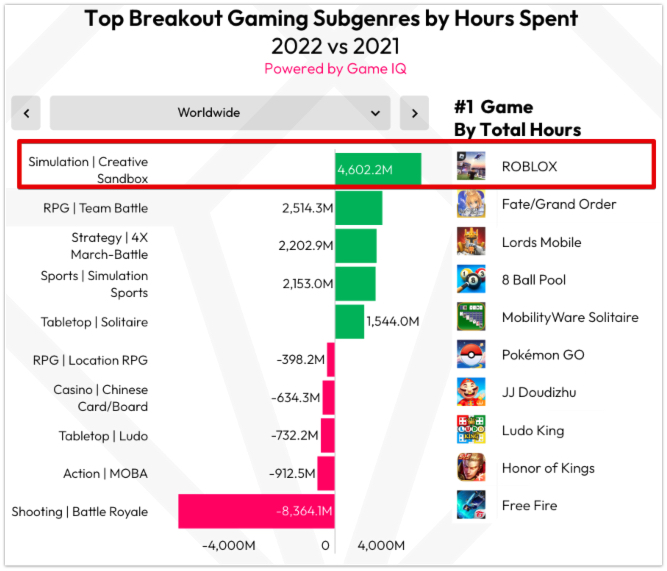

This is evidenced by Roblox’s recognition as the top Breakout Gaming app based on hours spent, according to Data.ai’s State of Mobile 2023 report[4]. These facts provide compelling evidence that the 3D real time UGC world that we envision is already here and thriving among future consumers.

The Promising Prospects of Roblox

When you log onto Roblox today, you’ll likely encounter a range of games presented by their discovery engine to capture attention and generate high levels of engagement. As we’ve noted, engagement equals monetisation potential, and we believe that 3D real-time content will serve as a foundation for high-value advertising. However, we also anticipate that advancements in AI-generated content technology could significantly enhance Roblox’s ability to democratise the creation of 3D real-time content.

High-Value Advertising

Thanks to its unique user demographic, Roblox is attracting top consumer brands who are exploring 3D real-time engagement. Through our research, we’ve found that this platform presents a remarkable advertising medium. It’s unlikely that we’ll remember a standard search ad while searching for shoes, but the experience of skating through a Vans World on Roblox will surely stay with us.

When comparing the experience of this conventional Instagram content video of skateboarders to the immersive Vans experience on the Roblox platform, the latter stands out as a more interactive and memorable advertising medium. Users can design their own Vans shoes and purchase them digitally for use in other Roblox games creating a lasting connection with the brand.

While the comparison of visits to followers may not be exact, the Vans experience on Roblox has demonstrated significant success

| Roblox Van’s World | 90m visits |

| Vans YouTube Subscribers | 656,000 |

| TikTok followers | 766,000 |

| Instagram followers | 3,700,000 |

The Vans Roblox experience has generated 90m visits, demonstrating the power of immersive brand experiences. In our research, we probably spent 10 mins playing around with the experience over a year ago and if we were generous, we could speculate that Vans spent, at most, $2m to hire a developer to create the experience (calculating to a ‘cost per click’ basis of $0.02c per ‘click’) to get ten minutes of our time.

A year later, we still recall the experience, while typical footwear ads are easily forgettable with an average cost per click of $0.29 and a cost per thousand impressions of $5.80[5].

The Vans Roblox experience shows the impact that engaging, memorable experiences can have compared to traditional advertising methods.

We hypothesise that the high level of interactivity offered by 3D real-time technology will result in higher advertising rates compared to traditional search advertising. This has the potential to become a lucrative revenue stream for Roblox in the medium term.

Enabling Creativity Through Generative AI

The skill gap between taking a photo (or video) and creating an interactive experience can be significant. However, the Roblox user base has played a meaningful role in teaching a new generation of young creators how to code, using their version of the Luau programming language[6]. This has the potential to create a strong and lasting developer ecosystem which can act as a strong moat from competitor platforms.

It typically takes a decade for a coding language to become established and widely adopted, but it is incredible to observe these young creators spend countless hours creating tutorials for their peers.

In recent years, generative AI has gained widespread attention, with stable diffusion models offering a simple way to convert text into images. Additionally, the advent of interactive chat mediums powered by large language models, such as ChatGPT, has opened new possibilities for less technical creators.

Below is an image that we created with the following text: “Skateboarder with Vans shoes in beach park” on Midjourney

The next big breakthrough in technology will likely come from the rapidly growing field of text-to-3D AI models. The success of image-to-text models can be traced back to the widespread use of ‘alt’ tags in HTML code, which provide a text description for images.

However, a similar corpus of labelled 3D models is currently not available at scale, as the models used in games and other applications are typically locked in executable code. Roblox, with its large user base and a vast collection of UGC 3D objects, has the potential to be a major player in this field by investing in generative AI technology. This would allow any user to create 3D experiences with ease, similar to creating stable diffusion art, and unlock a new realm of 3D content creation while reducing the complexity of coding.

In the past year, Roblox has made significant investments to enhance the realism of its engine, including advancements in materials, spatial audio, and layered clothing. These improvements are aimed at attracting an older demographic (17-24 year olds) and creators who can produce experiences for this age group. Although the younger user base of Roblox presents potential risks, such as a potential shift to another platform or the attraction of undesirable experiences, the company’s improving engagement metrics, expanding non-US user base, and maturing portfolio give us a reason for optimism.

A Few Portfolio Updates

- Brookfield Asset Management completed the spin-off transaction that we’ve been talking about for much of 2023. We now own a meaningful position in their ‘asset heavy’ called Brookfield Corporation which is comprised of real assets such as infrastructure, property, renewables, and private equity-related investment into these sectors.

Their asset management business has been spun off into a capital-light pure-play asset manager where we participate in their fees and carry in their underlying funds.

The transaction has yet to show any unlock of value. It’s too early to tell but at the sum of the parts level, we believe it is highly undervalued.

- Tencent has been a great example of buying a great company amid uncertainty. Over the last year, Tencent has been distributing its enviable investment portfolio to shareholders. We received our JD.com shares early in 2022 and just a few weeks ago we received our Meituan shares. On top of this, Tencent has been repurchasing its shares in the market. These relatively simple actions have created substantial value for shareholders over the last few months.

- Brait abandoned its IPO of Premier, its cash cow business, and has sold this stake to an anchor investor.This transaction significantly de-risks the business and will allow management to pay a portion of their convertible bonds down early. The convertible bonds are standing in the way of the other Brait assets being spun out to shareholders.

Our exchangeable bonds mature next year in December 2024 and whilst we wait, we receive a modest interest rate on our capital. If this all goes to plan, we should start to see a faster pace of realisation in this undervalued asset before December next year.

*****

As always, we remind co-investors that the majority of our liquid wealth is invested in the same fund as yours. We share in the ups and, inevitably, downs with you.

Warmly,

David Eborall

Portfolio Manager

Disclaimer

Collective investment schemes are generally medium to long-term investments. The value of participatory interest (units) or the investment may go down as well as up. Past performance is not necessarily a guide to future performance. Collective investment schemes are traded at ruling prices and can engage in borrowing and scrip lending. A Schedule of fees and charges and maximum commissions, as well as a detailed description of how performance fees are calculated and applied, is available on request from Sanne Management Company (RF) (Pty) Ltd (“Manager”). The Manager does not provide any guarantee in respect to the capital or the return of the portfolio. The Manager may close the portfolio to new investors to manage it efficiently according to its mandate. The Manager ensures fair treatment of investors by not offering preferential fees or liquidity terms to any investor within the same strategy. The Manager is registered and approved by the Financial Sector Conduct Authority under CISCA. The Manager retains full legal responsibility for the portfolio. FirstRand Bank Limited is the appointed trustee. SaltLight Capital Management (Pty) Ltd, FSP No. 48286, is authorised under the Financial Advisory and Intermediary Services Act 37 of 2002 to render investment management services.

[1] We are reticent of using any words associated with a Metaverse or a persistent world that will become an Avatar movie-like world

[2] In the digital world, a photo of a heavy rock will be undifferentiated to a digital feather. They’re both just a bunch of pixels

[3] 3D Objects (or assets) have associated light properties, material textures, gravitational properties and a response framework to touch.

[4] Source: Data.ai, State of Mobile 2023, https://www.data.ai/en/go/state-of-mobile-2023/

[5] Source: https://adcostly.com/facebook-ads-cost/footwear

[6] Luau is a relatively complex language as it includes object-oriented programming as a basis